Concerned about your medical file? The links below are from Information and Privacy Commissioner / Ontario http://www.ipc.on.ca/english/Resources/IPC-Corporate/IPC-Corporate-Summary/?id=667

Author Archives: Admin2

Correcting medical information

Running hot

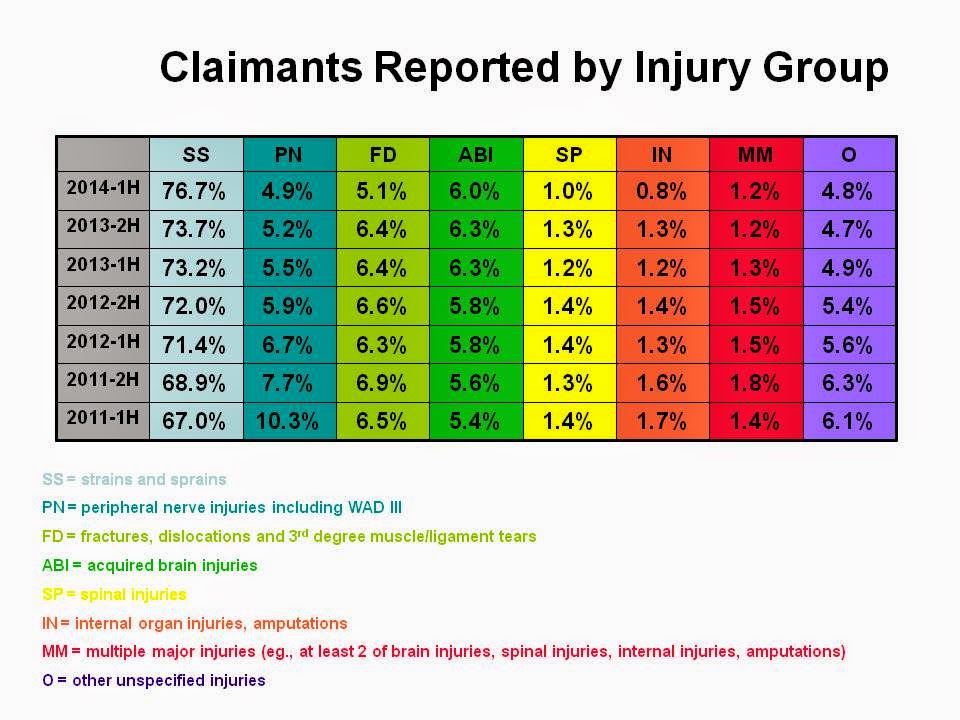

Private sector-run auto insurance systems in provinces across Canada are experiencing troubling loss trends in key areas. While reforms, such as minor injury caps, treatment protocols and anti-fraud measures, have had stabilizing effects in recent years, there are signs of overheating in claims frequency and severity. Adjusters argue that a more thorough approach to claims handling and statement taking at first notice is a sound way to address cost pressures.

http://www.claimscanada.ca/issues/article.aspx?aid=1003221555

What happens when a lawyer says something bad to an Ontario Jury: the case of the dismissed Jury

99% of all car accident and injury cases settle out of Court.

1% (or less) of car accident and injury cases do in fact go to trial.

link to the case can be found here

PwC advises insurers to outsource claims ‘where appropriate’

One leading insurer uses “third-party fraud frameworks within special investigative units, resulting in increased efficiency and accuracy by preventing, detecting, and managing claim fraud,” PwC said in the report. The un-named insurer also partners with “third-party data providers to provide real-time data (such as geospatial, workers’ compensation injury reporting) that is integrated into insurer’s claims operations.”

Revised Standard Benefit Statement

A system so dysfunctional with so many changes and band-aids that even FSCO cannot keep up and doesn’t have a clear idea of what benefits we do and don’t have – if THEY don’t know – how are we supposed to figure this stuff out?

Following further testing and development of the Standard Benefit Statement, which was released with Bulletin A-09/13 on December 20, 2013, a deficiency in the form has been identified. https://www.fsco.gov.on.ca/en/auto/autobulletins/2014/Pages/a-05-14.aspx

Is there a better system out there?

Insurers and stakeholders are struggling to find a cure for Ontario’s auto insurance woes. But the solution may lie right next door, says Echelon Insurance’s President and Chief Operating Officer, George Kalopsis.

http://www.insurancebusiness.ca/news/is-there-a-better-system-out-there-181471.aspx

Ruling raises questions about limitation periods

A leave to appeal on an Appeal Court ruling dismissed by the Supreme Court of Canada has raised the question of whether there is a limitation period on claims

Liberals Must Choose Between Ontario Drivers and Auto Insurance Industry

Liberals must choose between Ontario drivers and auto insurance industry – Today in the legislature, Bramalea-Gore-Malton MPP Jagmeet Singh asked Finance Minister Charles Sousa when Ontario drivers can expect to see some relief with…

http://insurernews.com/liberals-must-choose-between-ontario-drivers-and-auto-insurance-industry/

Province takes slow approach to reforming liability legislation

Hopes the province would act quickly to help cities stem soaring insurance costs were dashed at this week’s meeting of the Association of Municipalities of Ontario.

http://www.northernlife.ca/news/localNews/2014/08/20-insurance-sudbury.aspx